James Thickett

Digital Payments

Summary

I led discovery, strategy, and experience design for a digital payments initiative within a fuel card platform operating across the UK and Europe. The work aimed to reduce activation friction, de-risk a payment model dependent on physical cards, and create a more resilient payment experience for customers, fleet managers, and fuel retailers as industry infrastructure evolved.

My role spanned problem framing, UX strategy, mobile experience design, and collaboration across product, engineering, commercial, and external partners.

My Role

I led both experience strategy and business strategy across digital payments, focusing on how payment flows, decline handling, and account controls impacted customer behaviour, operational load, and commercial outcomes.

I worked closely with product, engineering, risk, finance, and operations to map payment journeys end-to-end, identify high-cost friction points, and shape prioritised initiatives that balanced user clarity, regulatory constraints, and business performance.

This included working with operational and finance partners to translate performance metrics into experience opportunities, and framing design work in terms of measurable business impact rather than interface or product experience improvements alone.

The Problem

The fuel card experience was tightly coupled to physical cards, creating activation delays, operational risk, and a fragile payment journey for both customers and retailers.

As the industry moved away from mag-stripe technology and retailers faced rising infrastructure costs, the existing experience became harder to activate, harder to manage at scale, and increasingly vulnerable to failure.

From a user experience perspective, this created multiple points of failure:

- Customers waited weeks from initial card order before they could transact, reducing confidence and early engagement

- Fleet managers struggled to route physical cards to the right drivers in large organisations

- Lost or delayed cards created support burden and workarounds

- Security - customers could lose cards, or they could be misused.

- These issues were not interface-level defects, but systemic experience risks rooted in the payment model itself.

The challenge was to design a payment experience with a supporting technology stack and business case that reduced these risks while remaining compatible with existing forecourt infrastructure and customer workflows.

Constraints & Risks

- Technology constraints: dependency on physical mag-stripe cards in a market actively phasing them out

- Infrastructure constraints: payment flows needed to work within existing forecourt environments

- Security & compliance: high trust, regulated payments domain

- Operational scale: large fleet customers with complex card distribution needs

- Commercial sensitivity: partnerships and roadmap details could not be exposed or assumed

- Any solution needed to reduce experience risk without fragmenting the platform or undermining trust.

Key Insights

Discovery revealed several critical experience patterns:

- Time-to-first-transaction was a make-or-break moment, delays dramatically reduced activation and confidence

- Physical cards amplified organisational friction, especially in large fleets where distribution, replacement, and control were ongoing challenges

- Control mattered as much as access, customers wanted clearer permissions, visibility, and security at the point of payment

- Experience reliability was the real differentiator, not novelty or new features

- These insights reframed the problem from “introducing digital payments” to designing a more immediate, controllable, and resilient payment experience.

Process

Payments are the product.

Personas:

- Fuel Retailers: seeking lower-cost unmanned operation and increased throughput

- Enterprise Fleet Managers: managing hundreds or thousands of cards and drivers

- Drivers / End Users: needing fast, low-friction payment at the pump

- Internal Commercial Teams: needing a proposition that could scale across markets

UX Research / Business Analysis:

- Qualitative research with customers and internal teams

- Journey mapping to identify activation and risk points

- Exploration of alternative experience models

- Rapid iteration with engineering to validate feasibility

- Quantified with revenue teams the impact of all changes across multiple business sectors.

- Analysis of the state of play and where the industry is headed

- Market forces / competitor analysis

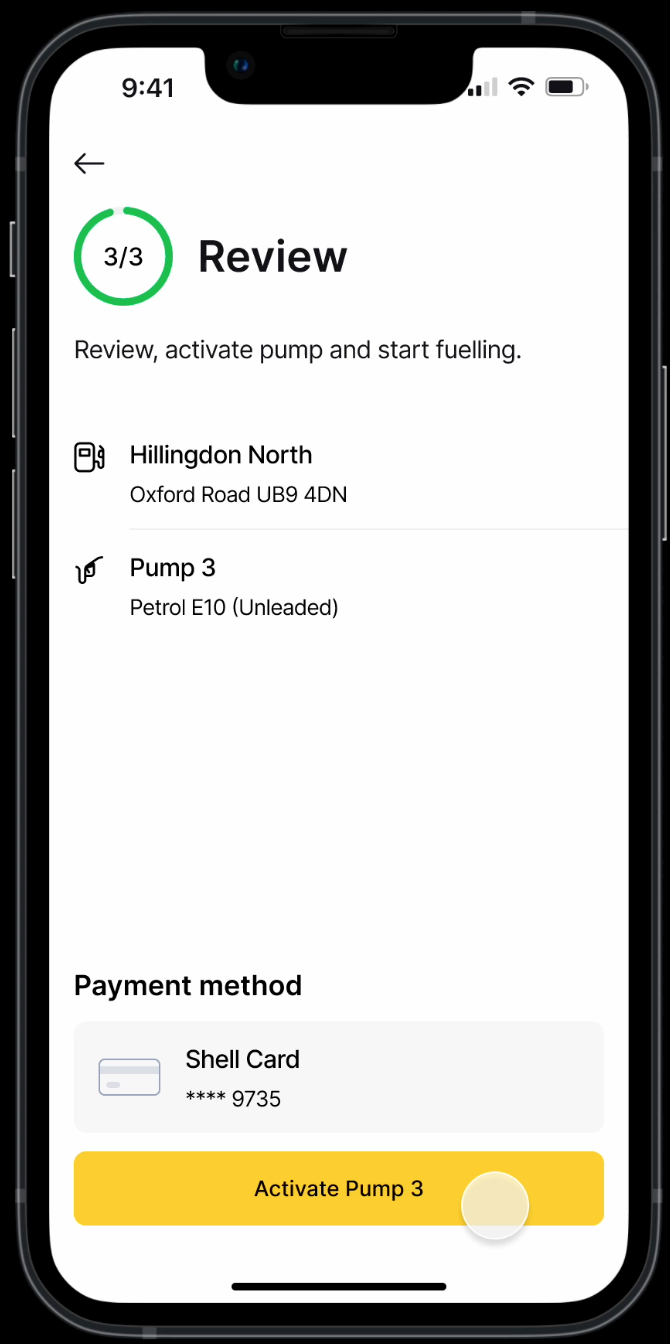

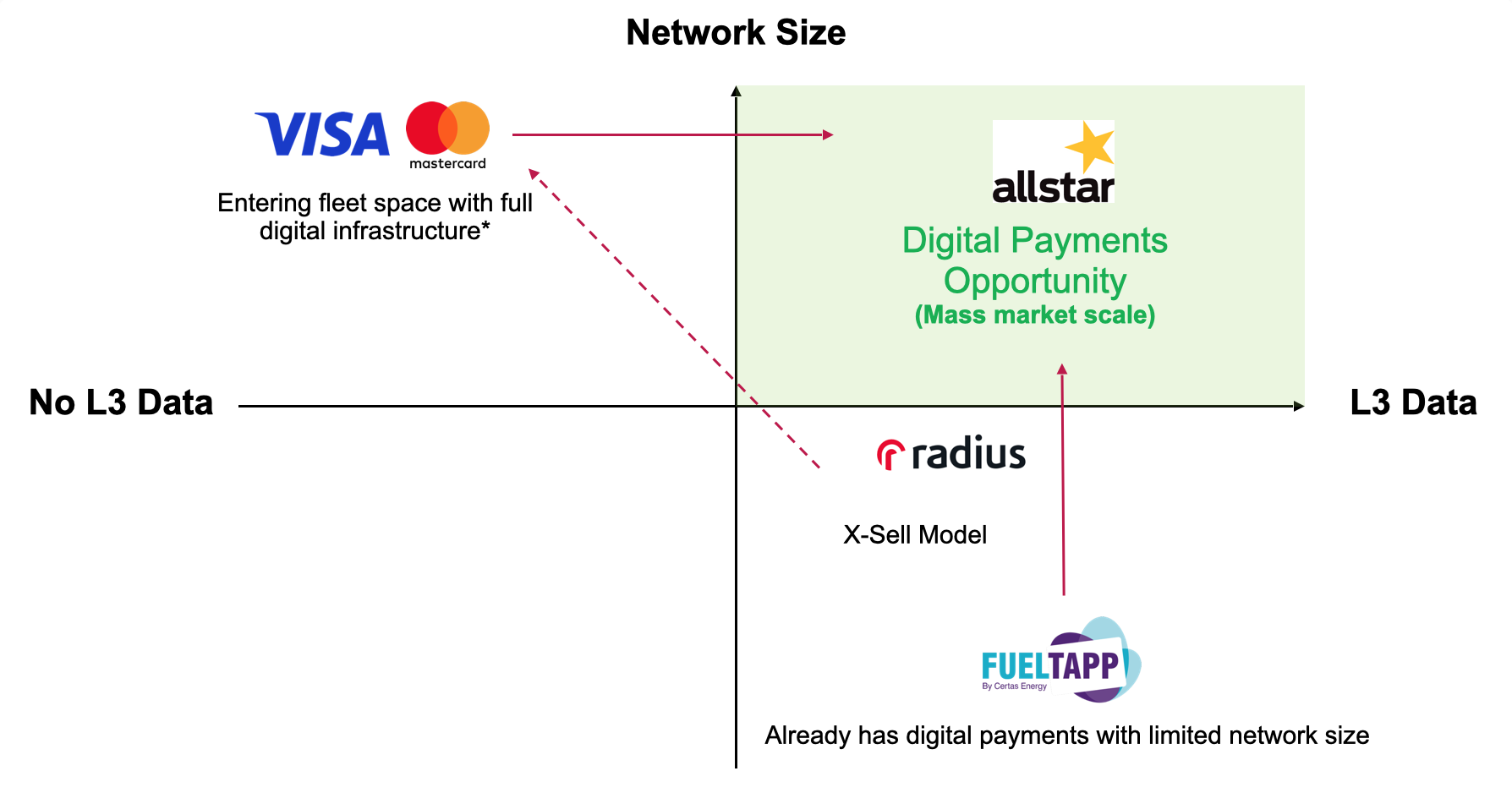

Market Analysis, L3 Data is the key to Fuel Cards. Visa and Mastercard are trying to get it, when they do, the game is up. Unless..... (Read on to see our solution)

Friction shows up in revenue.

Iterations & Exploration:

Rather than starting with screens, I focused on understanding the end-to-end payment journey as is, and to-be:

- Users: drivers, fleet managers, administrators

- Environments: mobile, forecourt, back-office systems

- Moments: ordering, activation, first use, exception handling

- We deeply explored apple and google wallet integration, but after engaging with multiple industry experts and consultants we decided it was too expensive and we would face industry pressure, IE lack of out door payment terminals. We decided an API based payment method was going to be the fastest to market.

Solution

We designed a digital payment experience that decoupled access and control from physical cards, while remaining compatible with existing infrastructure.

Key experience elements included:

- API based payment integration working with embedded fore-court technology, eliminating the need for costly installs of outdoor payment terminals.

- Instant access to digital cards

- Face ID / Alternative bio authentication methods prior to card authorisation locked in security and held drivers accountable.

- Focus on early app engagement to drive up MAU and engagement

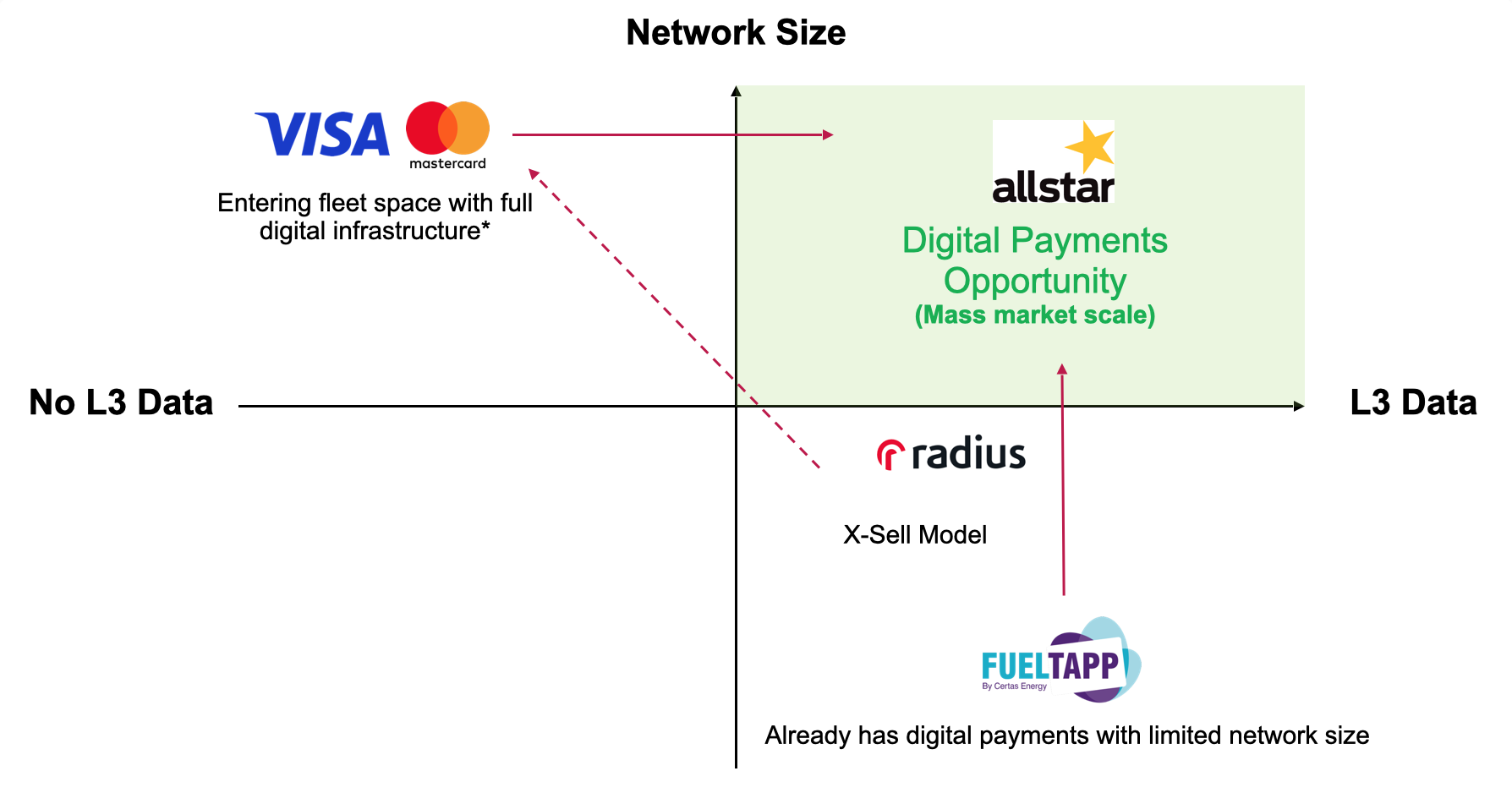

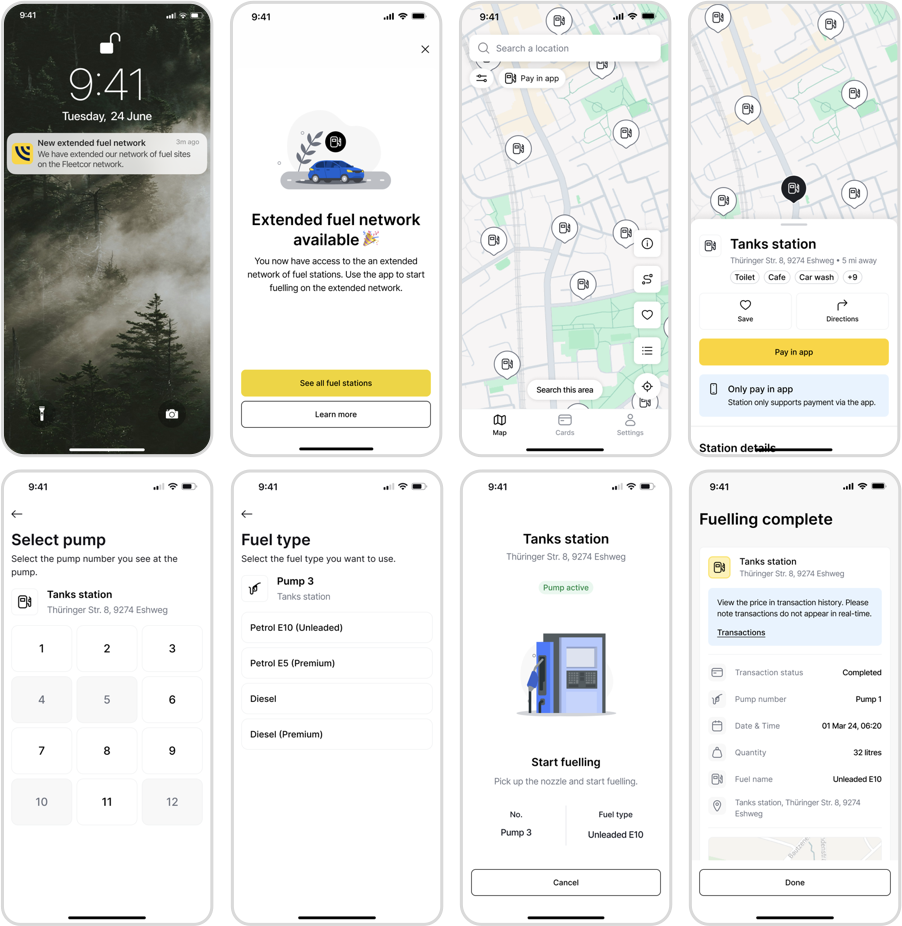

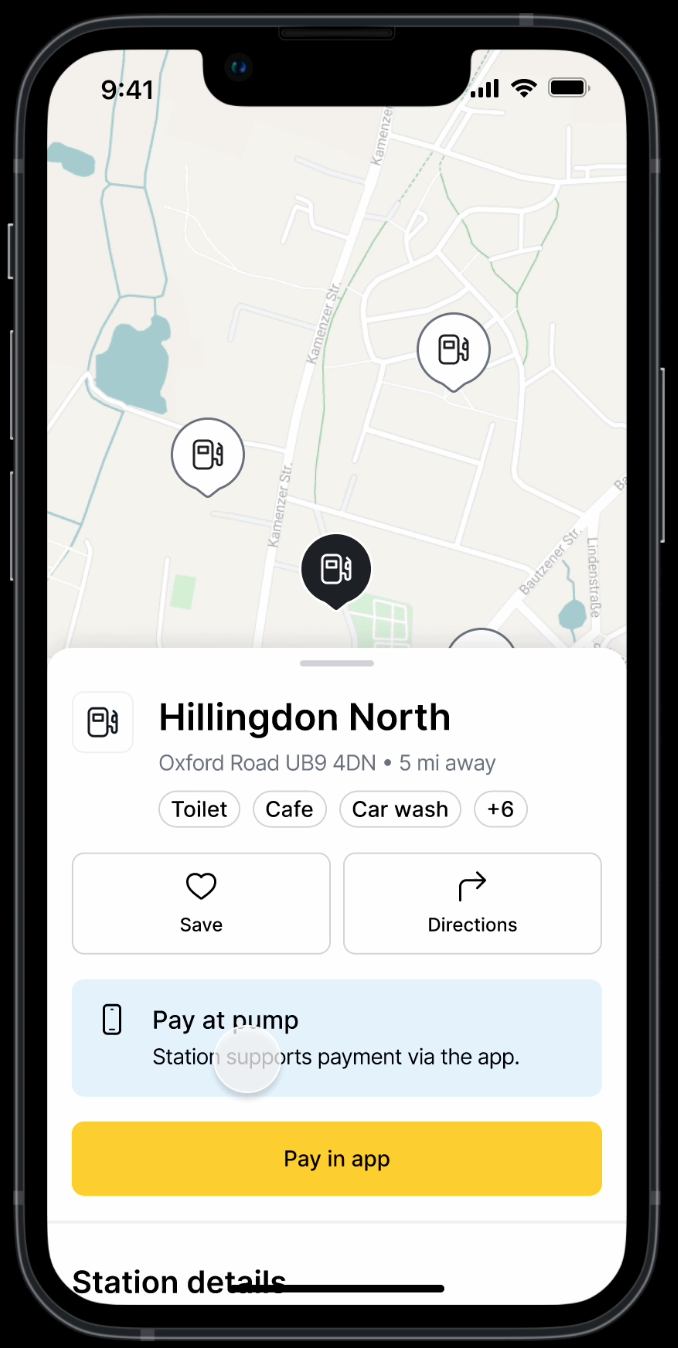

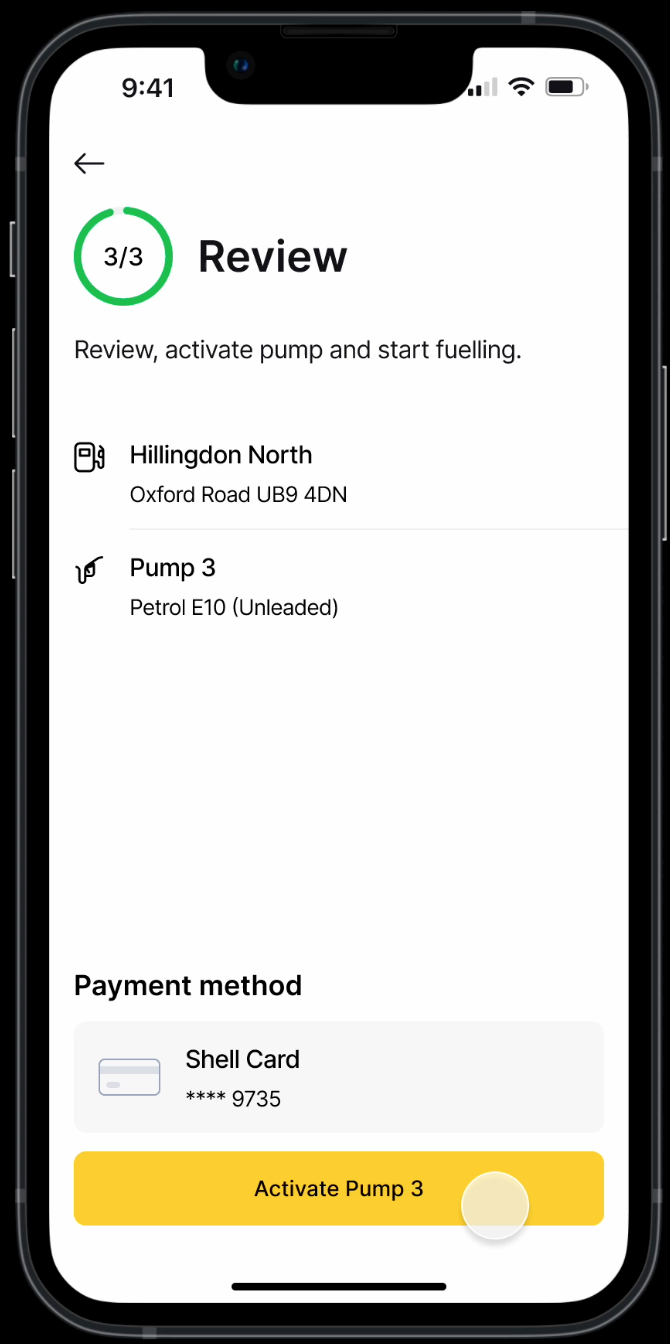

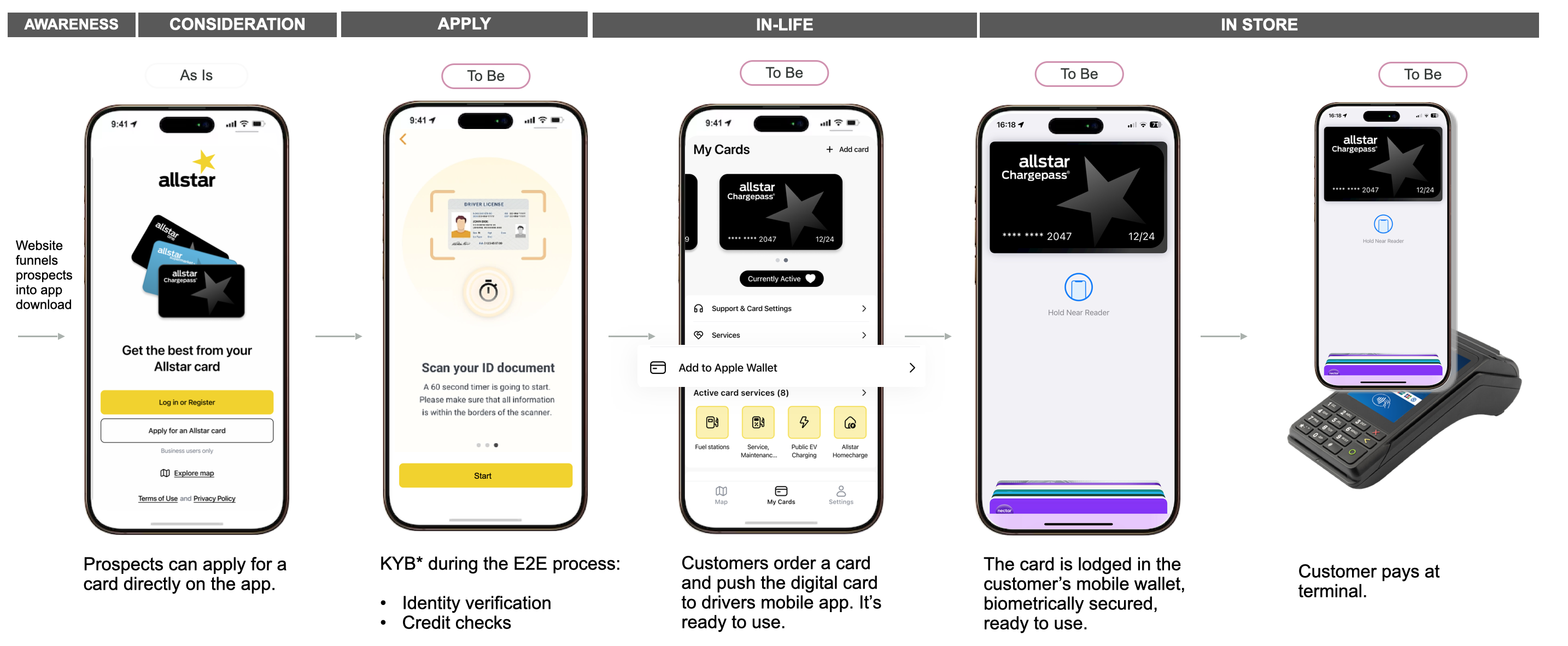

- Identified a north-star conversion flow (above) where app download is the first step for prospects, then a KYC process expedites the signup experience.

- Digital card management, reducing dependency on physical distribution

- Clear routing and visibility, simplifying use in large organisations

- Consistent mobile UX, reinforcing trust in a high-risk domain

- The solution treated payments as experience infrastructure rather than a feature.

Payment Flow

After applying: The thank you page was re-designed to show customers key proposition benefits, driving early engagement and also showed them tools they could start using now, such as our site locator and mobile app.

Impact

This work remained at discovery and validation stage, but achieved:

- Strong stakeholder alignment across product, technology, and commercial teams

- Validation of a materially lower-cost model for unmanned fuel sites

- An exclusivity agreement with the infrastructure provider

- A clear handoff to commercial teams to structure partnerships and rollout

£3,600,000 ARR

Projected ROI after year 2

Learnings

- UX can unlock strategy: reframing payments as software-driven permissions unlocked a 20x cost reduction

- Discovery work is often about removing assumptions, not adding features

- Physical infrastructure problems are frequently policy and experience problems in disguise

- Designing for enterprise scale requires treating admin and governance UX as first-class surfaces

- Early UX exploration was critical in building stakeholder confidence before commercial commitments

Next: Early Life Value >

Digital Payments

Summary

I led discovery, strategy, and experience design for a digital payments initiative within a fuel card platform operating across the UK and Europe. The work aimed to reduce activation friction, de-risk a payment model dependent on physical cards, and create a more resilient payment experience for customers, fleet managers, and fuel retailers as industry infrastructure evolved.

My role spanned problem framing, UX strategy, mobile experience design, and collaboration across product, engineering, commercial, and external partners.

My Role

I led both experience strategy and business strategy across digital payments, focusing on how payment flows, decline handling, and account controls impacted customer behaviour, operational load, and commercial outcomes.

I worked closely with product, engineering, risk, finance, and operations to map payment journeys end-to-end, identify high-cost friction points, and shape prioritised initiatives that balanced user clarity, regulatory constraints, and business performance.

This included working with operational and finance partners to translate performance metrics into experience opportunities, and framing design work in terms of measurable business impact rather than interface or product experience improvements alone.

The Problem

The fuel card experience was tightly coupled to physical cards, creating activation delays, operational risk, and a fragile payment journey for both customers and retailers.

As the industry moved away from mag-stripe technology and retailers faced rising infrastructure costs, the existing experience became harder to activate, harder to manage at scale, and increasingly vulnerable to failure.

From a user experience perspective, this created multiple points of failure:

- Customers waited weeks from initial card order before they could transact, reducing confidence and early engagement

- Fleet managers struggled to route physical cards to the right drivers in large organisations

- Lost or delayed cards created support burden and workarounds

- Security - customers could lose cards, or they could be misused.

- These issues were not interface-level defects, but systemic experience risks rooted in the payment model itself.

The challenge was to design a payment experience with a supporting technology stack and business case that reduced these risks while remaining compatible with existing forecourt infrastructure and customer workflows.

Constraints & Risks

- Technology constraints: dependency on physical mag-stripe cards in a market actively phasing them out

- Infrastructure constraints: payment flows needed to work within existing forecourt environments

- Security & compliance: high trust, regulated payments domain

- Operational scale: large fleet customers with complex card distribution needs

- Commercial sensitivity: partnerships and roadmap details could not be exposed or assumed

- Any solution needed to reduce experience risk without fragmenting the platform or undermining trust.

Key Insights

Discovery revealed several critical experience patterns:

- Time-to-first-transaction was a make-or-break moment, delays dramatically reduced activation and confidence

- Physical cards amplified organisational friction, especially in large fleets where distribution, replacement, and control were ongoing challenges

- Control mattered as much as access, customers wanted clearer permissions, visibility, and security at the point of payment

- Experience reliability was the real differentiator, not novelty or new features

- These insights reframed the problem from “introducing digital payments” to designing a more immediate, controllable, and resilient payment experience.

Process

Payments are the product.

Personas:

- Fuel Retailers: seeking lower-cost unmanned operation and increased throughput

- Enterprise Fleet Managers: managing hundreds or thousands of cards and drivers

- Drivers / End Users: needing fast, low-friction payment at the pump

- Internal Commercial Teams: needing a proposition that could scale across markets

UX Research / Business Analysis:

- Qualitative research with customers and internal teams

- Journey mapping to identify activation and risk points

- Exploration of alternative experience models

- Rapid iteration with engineering to validate feasibility

- Quantified with revenue teams the impact of all changes across multiple business sectors.

- Analysis of the state of play and where the industry is headed

- Market forces / competitor analysis

Market Analysis, L3 Data is the key to Fuel Cards. Visa and Mastercard are trying to get it, when they do, the game is up. Unless..... (Read on to see our solution)

Friction shows up in revenue.

Iterations & Exploration:

Rather than starting with screens, I focused on understanding the end-to-end payment journey as is, and to-be:

- Users: drivers, fleet managers, administrators

- Environments: mobile, forecourt, back-office systems

- Moments: ordering, activation, first use, exception handling

- We deeply explored apple and google wallet integration, but after engaging with multiple industry experts and consultants we decided it was too expensive and we would face industry pressure, IE lack of out door payment terminals. We decided an API based payment method was going to be the fastest to market.

Solution

We designed a digital payment experience that decoupled access and control from physical cards, while remaining compatible with existing infrastructure.

Key experience elements included:

- API based payment integration working with embedded fore-court technology, eliminating the need for costly installs of outdoor payment terminals.

- Instant access to digital cards

- Face ID / Alternative bio authentication methods prior to card authorisation locked in security and held drivers accountable.

- Focus on early app engagement to drive up MAU and engagement

- Identified a north-star conversion flow (above) where app download is the first step for prospects, then a KYC process expedites the signup experience.

- Digital card management, reducing dependency on physical distribution

- Clear routing and visibility, simplifying use in large organisations

- Consistent mobile UX, reinforcing trust in a high-risk domain

- The solution treated payments as experience infrastructure rather than a feature.

Payment Flow

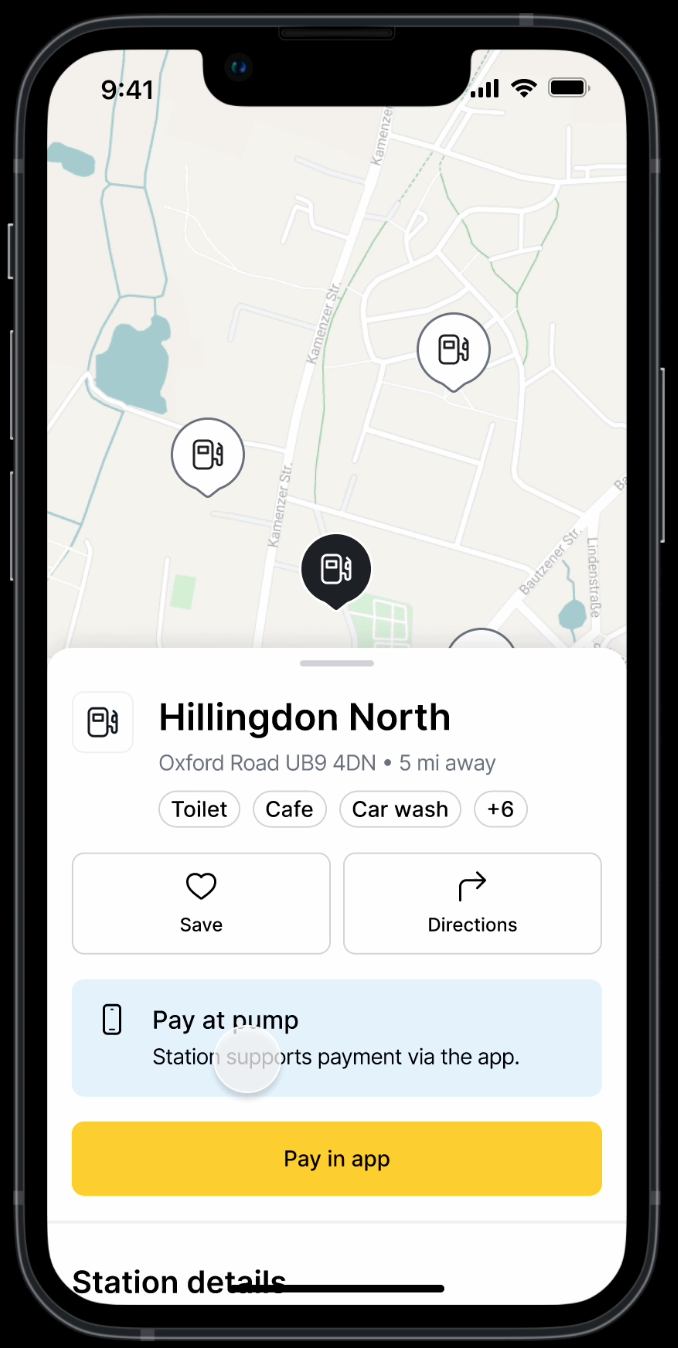

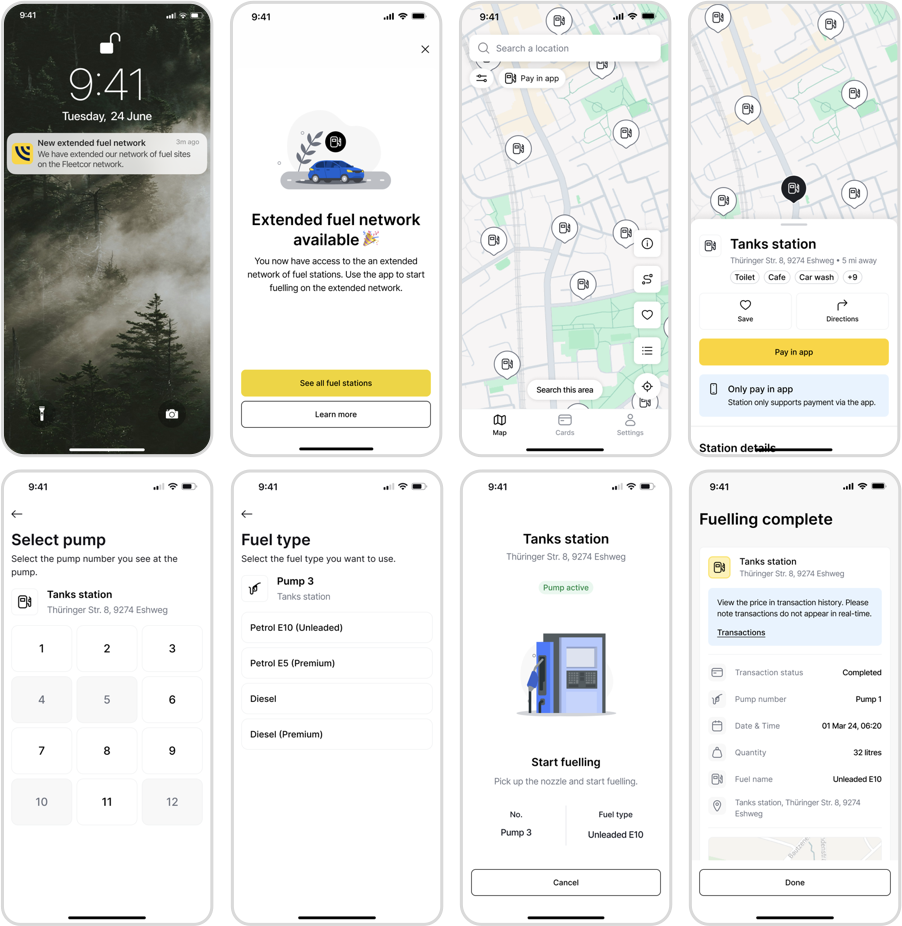

Watch the video above: If the video does not play, you can see the screen flow below.

It shows the user being able to navigate to a site which accepts in app payment, the user then is bio metrically authenticated before the payment is authorised.

Impact

This work remained at discovery and validation stage, but achieved:

- Strong stakeholder alignment across product, technology, and commercial teams

- Validation of a materially lower-cost model for unmanned fuel sites

- An exclusivity agreement with the infrastructure provider

- A clear handoff to commercial teams to structure partnerships and rollout

£3,600,000 ARR

Projected ROI after year 2

Learnings

- UX can unlock strategy: reframing payments as software-driven permissions unlocked a 20x cost reduction

- Discovery work is often about removing assumptions, not adding features

- Physical infrastructure problems are frequently policy and experience problems in disguise

- Designing for enterprise scale requires treating admin and governance UX as first-class surfaces

- Early UX exploration was critical in building stakeholder confidence before commercial commitments

Next: Early Life Value >